25 Best Credit Cards in India [Detailed Reviews]

Entry Level Credit Cards

- Suggested income: 5 Lakhs+

- Suggested spend: 1 Lakhs+

Entry-Level credit cards, also called as credit cards for beginners are those cards that are targeted at first-time credit card users.

SBI Cashback Card

- Best for: Upto 5% Cashback on Online spends

- Read Review & Apply: SBI Cashback Credit Card

SBI Cashback Credit Card is the HOT pick of the year for entry-level cardholders as 5% Cashback on online spends is lucrative even after the recent devaluation. With a pretty good max cap of 5,000 INR a month, it equates to 1L monthly spends.

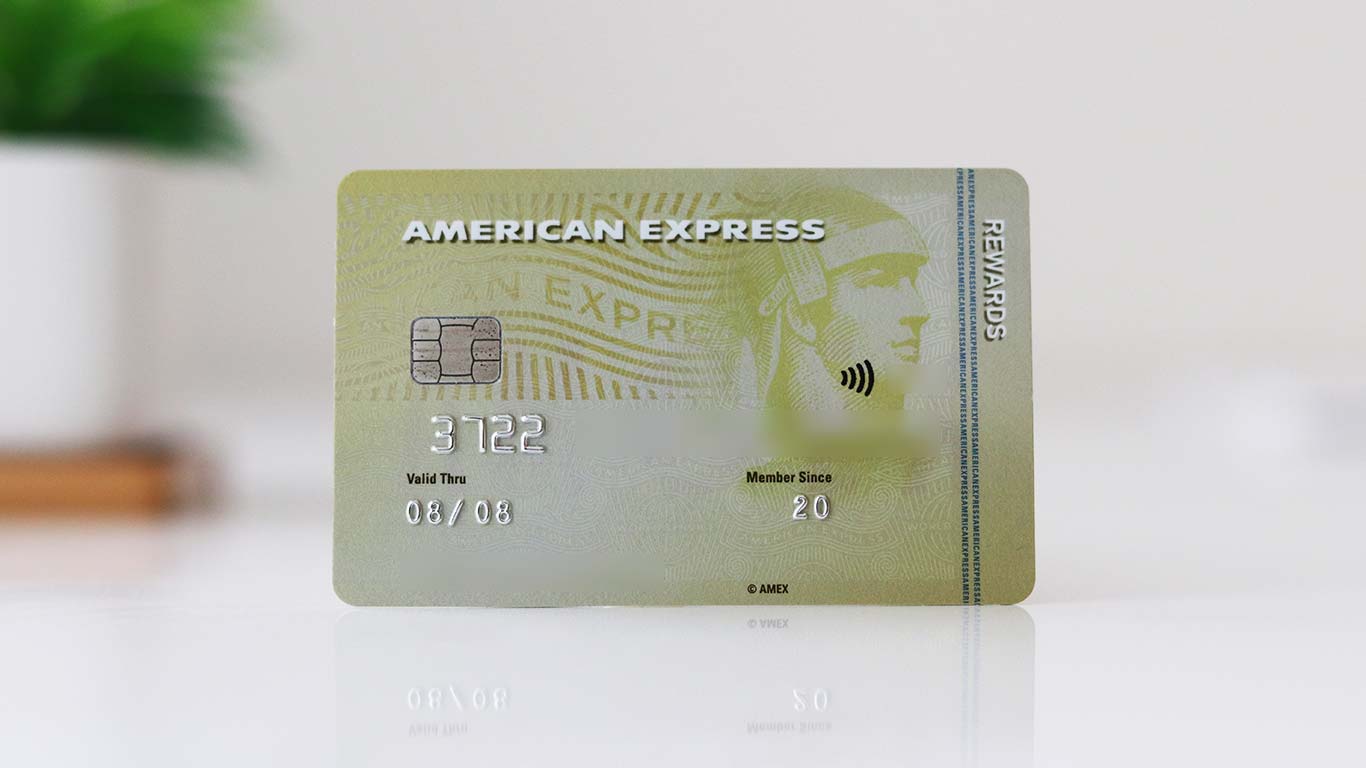

Amex MRCC

- Best for: Gold Collection & Points Transfers

- Read Review & Apply: American Express MRCC Review

American Express Membership Rewards Credit Card (MRCC) is the best way to get into the world of Amex. If you use this card just to get the 2000 MR bonus points monthly (20K spend), you can easily get a return of 6% on spends.

Apart from that, you will also get access to the amazing Amex Offers (merchant offers & spend linked offers) which are quite good most of the time.

ICICI Amazon Pay

- Best for: 5% return on Amazon spends

- Apply from Amazon App

If you shop frequently on Amazon and if you’re an Amazon Prime customer, you cannot afford to miss this wonderful card as it’s anyway a lifetime free credit card.

Premium Credit Cards

- Suggested income range: 12 Lakhs+

- Suggested spend range: 6 Lakhs+

Premium credit cards comes into picture when your lifestyle has pinch of luxury factor to it. It comes with more travel benefits like domestic and international lounge access, better reward rate, etc.